This story was updated on Oct. 15 to reflect final totals after the last deadline for putting measures on the ballot had passed.

Will 2014 be the year that voters in Colorado school districts loosen up their wallets and approve well more than $1 billion in local tax increases for school construction and operations?

A year ago, voters were almost as skeptical of local proposals as they were of Amendment 66, the $1 billion K-12 statewide income tax hike that was defeated overwhelmingly. Hoping that voters are in a different mood this year, some two dozen Colorado school districts are seeking some $1.5 billion in property tax increases for construction projects and operating funds.

“On the bond side, it’s going to be the largest group of bonds that anybody’s ever seen,” said Tracie Rainey, executive director of the Colorado School Finance Project, which compiled the detailed list displayed at the bottom of this article.

This year’s ballot measures are interesting for several important reasons, including:

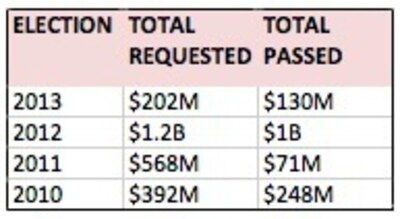

A big year – The total $1.4 billion request exceeds the nearly $1.2 billion districts proposed in 2012, although there were 38 measures on the ballot that year, compared to about 30 this year.

Boulder has biggest ask – The Boulder Valley School District is asking for a $576.4 million bond issue this year, exceeding the high set previously by the $515 million combined bond and override requested – and won – by Denver Public Schools in 2012.

Five Adams districts asking – Most of the money – about $1.1 billion – is being requested from voters in just two counties, Adams and Boulder. Five districts in western Adams all are on the Nov. 4 ballot, an apparently unprecedented event.

Financial pressures – Despite a modest bump in school funding provided by the 2014 legislature, district leaders say that additional money is far from enough, and they have to ask voters for additional local revenues to cover building and program needs that can’t be put off.

A possible distraction – A statewide casino-expansion proposal, Amendment 68, is also on the ballot, and it promises more than $100 million in additional revenues for schools. District leaders are skeptical of A68’s promises and hope it doesn’t confuse voters about the need for local revenue. (Get details on A68 here.)

BEST off the ballot – For the first time in several years, 2014 ballots don’t include a long list of small districts seeking bond issues to raise local matching funds for Building Excellent Schools Today construction program grants. (There’s only one such local measure this year.) The state portion of that program has reached its ceiling for larger projects such as new schools and major renovations, so there’s no money for locals to match.

Voter mood – Finally, the 2014 election may provide an update on where some voters stand on school taxes. Voter attitudes have been on a roller coaster in this decade. District tax proposals received reasonable support in 2010, but 2011 was the worst year in memory for bonds and overrides. Voters were very supportive in 2012 but returned to their skeptical ways last year. Of course, voters rejected statewide proposals to increases taxes for schools in 2011 and 2013.

Boulder – the big ask

“This is a big ask, we understand that,” says Boulder Valley Superintendent Bruce Messinger when questioned about his district’s proposal for a $576.4 million bond issue. “It’s a hard choice.”

But, he added, “The facilities needs are not going to go away,” and if building systems begin to fail the 30,500-student district isn’t in a position to cover significant building costs from its general fund.

About half the money would be used to bring all district buildings “to acceptable standards,” he said, with the rest devoted to a variety of other needs. (See the district’s detailed facilities plan here.)

As is common with larger districts, Boulder went through a long planning and public consultation process before the board approved the ballot proposal in August.

Messinger said polling put the district’s overall approval rating is at “an all-time high” and that polling and focus groups indicate, “Taxpayers understand … schools are assets.”

While Messinger is feeling reasonably good about the proposal’s chances, he does note the possible of confusion with Amendment 68. “It’s a concern,” he said. “It’s on people’s minds.”

Boulder has had a history of success with its voters. It last lost an election in 2002, when voters rejected a $7.5 million override that would have funded technology improvements.

Adco’s “referendum” on school spending

While Denver, Douglas and Jefferson counties have but one school district each, Adams County is served by seven. Each district is considerably smaller than DPS or Jeffco, but combined the five largest districts in Adams had about the same enrollment as their neighboring counties did in 2013-14, about 85,000 students.

This year most Adams County voters have the rare opportunity to vote on school taxes at the same time. Those five districts – Adams 12-Five Star, Brighton, Commerce City (Adams 14), Mapleton and Westminster (Adams 50) – all have proposals on the ballot.

All but Brighton are seeking both bond issues and overrides for varying reasons. Each district is seeking bond money to upgrade existing buildings, while new schools would be built in growing parts of Adams 12, Brighton and Commerce City. Tax override revenues would be used to recruit and retain teachers, offset state budget cuts and cover a variety of needs. (See the spreadsheet at the bottom of this story for details on those district proposals and all tax measures statewide.)

Adams 12 Superintendent Chris Gdowski said the five sets of ballot measures weren’t coordinated but, “What’s driving it are common factors. We all have needs that haven’t been met.”

For Adams 12, he said, “The need is pressing, and we can’t wait any longer.”

Other county superintendent sounded the same note. “We decided to go this year because our needs just continue to mount,” said Mapleton Superintendent Charlotte Ciancio. “We have just been so far behind for so long … we just had to go.”

Westminster Superintendent Pamela Swanson said, “We’re trying to avoid any more cuts. We have some wonderful things happening, and we don’t want to take any steps backwards. We felt a moral obligation to go back out” to the voters, even though the district saw a $5.2 million override defeated last year.

Commerce City Superintendent Pat Sanchez had a bond issue defeated last year by about 300 votes. He called that a “hidden blessing” that forced the district “to be really crystal clear about what the voters are getting” this year. He and other Adams superintendents are hopeful that academic improvements in recent years will make voters more amendable to tax hikes.

Adams 12, Brighton and Mapleton are rated as “improvement” districts by the state accreditation system. Commerce City and Westminster are “priority improvement” districts but have moved up in recent years from “turnaround,” the lowest accreditation category.

Superintendents have varying answers about what happens if proposals are defeated. Gdowski said a loss could mean schedule changes in Adams 12. Sanchez said defeat “would change a five-year plan to a 10-year plan,” and Ciancio said, “If it doesn’t pass we’ll just have to keep going back to the ballot.”

Around the state

Two districts in El Paso County also have large measures on the ballot. Cheyenne Mountain is proposing a $45 million bond, and Falcon’s bond proposal totals $107.4 million.

Denver voters face a proposed sales tax increase and an extension for the Denver Preschool Program, which is separate from DPS. (Get more details here.)

There are no district proposals on the ballot this year in Denver, Douglas County, Jefferson County or in any of Arapahoe County’s seven districts.

State law bars school boards and districts from spending public funds on ballot measure campaigns.

The campaign load typically is carried by outside citizen campaign committees that raise money for brochures, yard signs and other materials. Such committees already have been formed in Boulder, in most of the Adams County districts and in Cheyenne Mountain and Falcon.

The bigger issue

Passage of bond issues and overrides in individual districts has the unwelcome side effect of increasing gaps between districts that have the political and financial capacity to pass them and those that don’t. (There’s a limit on district bond debt based on the value of property within a district, and there also are state ceilings on overrides.)

“The long range solution to this [school funding] is not doing this district by district,” Messinger said. “I worry that the gap [between districts] could widen over time,” said Gdowski.

But Sanchez, noting that there’s still a $900 million shortfall in state school funding, said it’s hard to districts to resist the pressure to raise their own money. “I think you’re going to see a trend of more bonds and mill levy overrides.”

This spreadsheet includes information gathered by the Colorado School Finance Project as of Oct. 6.