Gov. Jared Polis and Colorado legislative leaders announced a deal Monday to provide property tax relief to homeowners and businesses while limiting the hit to school funding.

Lawmakers have exactly a week to move the bill through both chambers of the Colorado General Assembly, where Republicans have slowed the movement of bills to a crawl with extended floor debates.

That bill would place Proposition HH on the November ballot. Then Colorado voters would need to give their approval.

“What really makes this proposal special is that while we can save Coloradans money on property taxes in the short and the long term, we can also at the same time protect the funding for our schools or fire districts or local governments that we all rely on every day,” said Senate President Steve Fenberg, a Boulder Democrat.

The governor’s office provided reporters with a two-page summary of the proposal. However, neither the actual bill nor the fiscal analysis was available Monday afternoon.

Proposition HH would reduce the assessment rate for both primary residences and commercial and agricultural properties. The assessment rate determines how much of a property’s value is subject to taxation.

It also would limit the annual growth of property tax collections to roughly the rate of inflation — except for school districts, which could continue to benefit from rising home values.

The proposal also would not tax the first $40,000 of home value for most homeowners. People 65 and older and disabled veterans who qualify for the so-called homestead exemption would get $140,000 of home value tax free and could retain that tax break even if they move, potentially making it easier for some people to downsize. The current homestead exemption exempts half of the first $200,000 of home value and requires the owner to have lived in their home for at least 10 years.

Without any property tax relief, the average Colorado homeowner is likely to pay about $1,068 more this year, roughly $89 more each month if they pay their taxes with their mortgage. Under the proposal, that increase would be just $401 this year, closer to $33 a month.

At the same time, voters would be asked to let the state keep some revenue above the limit set by the Taxpayer’s Bill of Rights. Under current law, state government cannot grow by more than the rate of inflation plus population, and any tax collections above that from Colorado’s strong economy must be returned to the taxpayers.

Proposition HH would let the state keep an additional 1% above that cap and use that money to backfill local governments — such as school districts, fire districts, water districts, and hospital districts — that stand to lose some property tax revenue. Voters have rejected past efforts to eliminate TABOR refunds, though this proposal is more modest than previous attempts.

In 2024-25, that would add about $167 million more to a state budget of about $40 billion. The state’s TABOR surplus — the amount that needs to be returned to taxpayers as additional refunds — would shrink from $2 billion to $1.8 billion.

This system would be in place for the next 10 years if Proposition HH were to pass.

Colorado schools are funded with a mix of local property taxes and state money. After determining how much money per student each school district should get according to a formula, the state is supposed to backfill whatever local taxes don’t generate.

But when state lawmakers decide they can’t afford to meet that obligation and still pay for other budget priorities, they have withheld money — $10 billion over the last 13 years — in a move known as the budget stabilization factor.

Voters in many school districts have also approved additional property taxes to make up for lost state revenue and cover programs like counselors, arts and music, school nurses, or higher teacher pay.

That means any discussion of property tax relief has the potential to hit school district budgets hard, even as many families and school employees struggle to keep up with rising costs. (Renters won’t be getting any relief this session after a bill to allow cities to adopt rent control or rent stabilization died in committee, though Polis said his proposal would prevent property tax increases from being passed on to renters.)

Homeowners across the state are receiving updated property valuations this week that average 33% more than they did two years ago — and as high as 60 to 70% more in some mountain communities. These valuations are based on market snapshots from summer 2022, when the state’s real estate market was at its peak. Since then, with higher interest rates, home sales have dropped and home prices have declined slightly.

In anticipation of significant increases in property values, Polis promised relief in his State of the State address. Lawmakers are also hoping to fend off a number of competing ballot measures.

By reducing assessment rates, lawmakers would reduce the amount of property value subject to local taxes.

But by exempting school districts from caps on how much tax collections can increase year over year — and by increasing the amount of money the state can use to backfill lost local dollars — the measure would soften the impact on school funding.

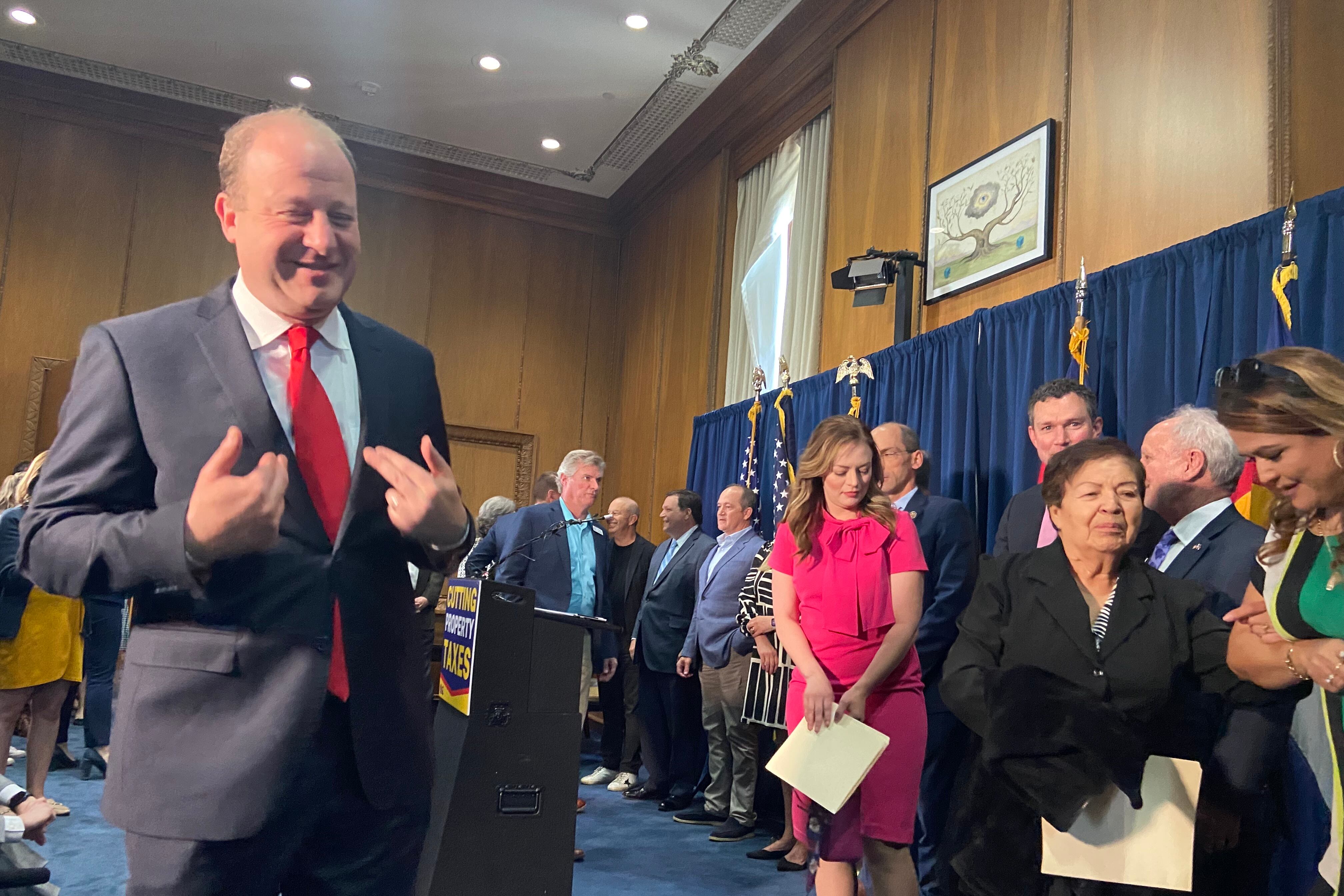

Polis, Fenberg, and state Sen. Chris Hansen were flanked by advocates for education and progressive fiscal policies in support of the proposal, as well as several homeowners and small business people who talked about how they were feeling the pinch of higher taxes.

Jen Walmer of Democrats for Education Reform called the proposal a “win-win for schools and communities” and Amie Baca-Oehlert, president of the Colorado Education Association, said it would help teachers and school staff whether they own or rent.

Also present were business groups such as Colorado Concern and the Denver Metro Chamber of Commerce.

No Republican lawmakers attended the announcement. In a press release, Republicans blasted the “eleventh hour” plan and questioned why their Democratic colleagues had killed or slow-walked Republican-sponsored property tax relief plans.

“The Democrats cannot treat TABOR like an ATM machine to resolve the state’s financial issues, most of which are self-inflicted,” House Minority Leader Mike Lynch said in the press release. “The people of Colorado should be skeptical of the Governor’s hastily introduced plan with only one week left in the session.”

Lynch, a Wellington Republican, called it a “sugar-coated plan” and said it is “concerning the Governor has no PLAN B if it fails.”

Scott Wasserman, executive director of the progressive Bell Policy Center, said the proposal doesn’t solve school funding, but it does address two major concerns his organization had with other property tax relief proposals. People who own homes with lower values would benefit more than those whose homes are worth more, and funding for key services is maintained.

Leaders of the groups that represent school boards and superintendents said they appreciated that the proposal calls out the need to protect school funding, but said they’re waiting to see the actual bill before taking a position.

Bureau Chief Erica Meltzer covers education policy and politics and oversees Chalkbeat Colorado’s education coverage. Contact Erica at emeltzer@chalkbeat.org.